Credit balances in healthcare accounts occur when a patient or insurance payer overpays, resulting in excess funds in the provider’s system. Left unresolved, these balances can create financial discrepancies, compliance risks, and affect the accuracy of revenue reporting. Efficient management of credit balances is crucial for healthcare providers to maintain clean accounts, improve cash flow, and comply with regulatory requirements.

What Are Credit Balance Services?

Credit Balance Services are specialized revenue cycle management solutions designed to identify, investigate, and resolve overpayments in healthcare accounts. These services include:

Identification: Reviewing patient and insurance accounts to detect overpayments or duplicate payments.

Analysis: Determining the source of the credit—whether it’s from patient payments, insurance adjustments, or billing errors.

Resolution: Coordinating refunds to patients, adjusting accounts with insurance companies, and correcting any systemic errors in billing.

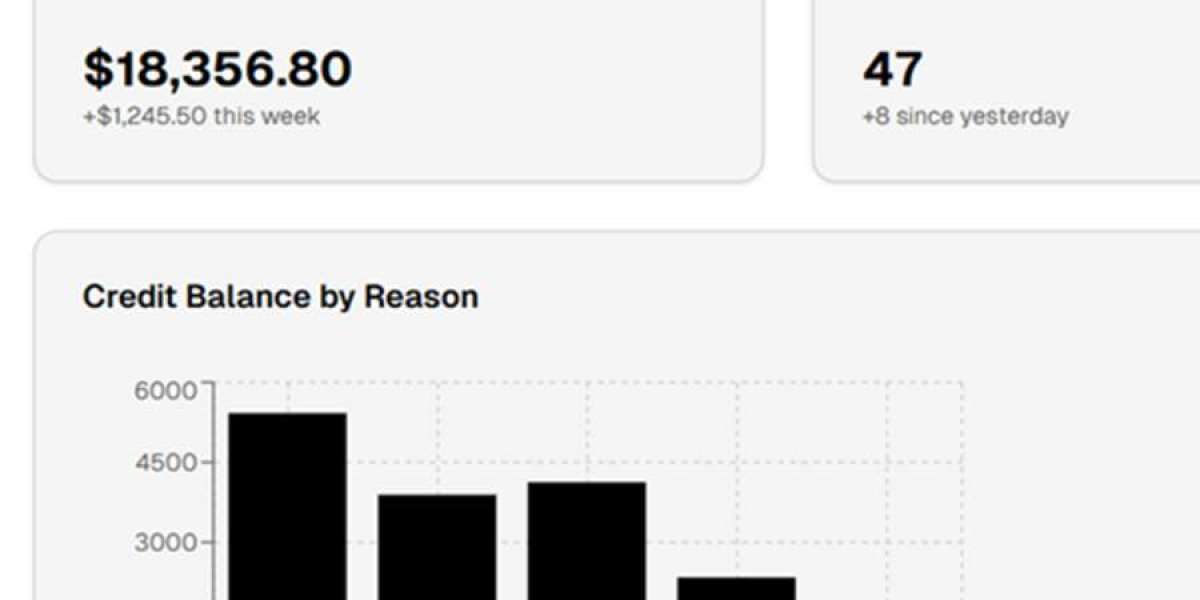

Reporting & Compliance: Generating detailed reports to track credit balances and ensuring compliance with healthcare regulations and payer requirements.

Benefits of Credit Balance Services:

Improved Cash Flow: By quickly resolving overpayments, providers can reinvest resources and reduce unnecessary delays in revenue cycles.

Reduced Compliance Risks: Proper handling of credit balances minimizes the risk of audits, fines, or regulatory penalties.

Enhanced Accuracy: Resolving discrepancies ensures patient accounts and financial statements remain accurate.

Operational Efficiency: Outsourcing credit balance management allows internal staff to focus on core patient care activities.

Why Outsource Credit Balance Services?

Managing credit balances in-house can be time-consuming and prone to errors, especially for large healthcare practices. Outsourcing to experienced RCM professionals ensures:

Faster resolution of overpayments.

Reduced risk of compliance violations.

Access to advanced tools and expertise for accurate account reconciliation.

Conclusion:

Credit Balance Services are an essential part of modern revenue cycle management, helping healthcare providers maintain financial accuracy, regulatory compliance, and operational efficiency. By leveraging specialized services, providers can focus on delivering high-quality patient care while ensuring their revenue cycle remains healthy and error-free.